The Importance of Accurate, Real-time Records for R&D Tax Relief Claims in the UK

Effective from 8 August, new requirements for filing and claiming Research and Development (R&D) tax relief in the UK will demand meticulous record-keeping to avoid lengthy and onerous information gathering exercises come the company’s year end. Let’s explore what essential records of qualifying R&D projects need to be kept for meeting these new requirements.

Scientific or Technological Advances

Accurate records should encompass the details of the scientific or technological advances sought through the respective R&D projects. By documenting the specific objectives and goals, the records provide a clear picture of the project’s intended outcomes. Additionally, recording the scientific or technological uncertainties encountered during the research process is vital. This highlights the challenges faced and establishes the project’s eligibility for R&D tax relief.

Overcoming Uncertainties

Detailed records should elucidate how each of the scientific or technological uncertainties were overcome. This documentation offers insights into the innovative approaches and problem-solving techniques applied during the R&D process. It demonstrates the project’s eligibility for tax relief by showcasing the genuine efforts made to overcome challenges and achieve advancements.

Qualifying Expenditure and R&D Activity

Maintaining detailed records of qualifying expenditure by individual projects is crucial. The records should clearly outline the costs incurred during R&D activities, such as materials, employee wages, subcontractor expenses and indirect qualifying activities per individual project. These records help demonstrate the legitimacy of expenses claimed, ensuring compliance with the new guidelines.

Scientific or Technological Advances

Integer quis lorem pulvinar nulla eleifend pretium sed quis elit. Nullam vehicula id eros vitae blandit. Fusce eu vestibulum erat. Pellentesque molestie in arcu a fermentum. Maecenas tempus vestibulum enim at fermentum. Mauris eget eleifend neque, ac varius lacus. Aliquam quis urna aliquam orci iaculis faucibus. Curabitur at justo vehicula, cursus justo quis, iaculis nisl. Sed facilisis aliquam velit vel tempus. Duis varius nibh sed quam pulvinar imperdiet. Cras turpis nulla, fermentum eget aliquet ac, rutrum id libero.

Team Members and Subcontractors

The new requirements highlight the necessity of recording the specific team members or subcontractors involved in the R&D project. Accurate records should outline their roles, responsibilities, qualifications and methodology for apportioning their time and costs. This information validates the expertise employed in the research, reinforcing the claim for R&D tax relief.

Conclusion

With the updated requirements for R&D tax relief claims in the UK, accurate, real-time record-keeping has become imperative. Maintaining detailed records of qualifying expenditure, R&D activities, scientific or technological advances, uncertainties and their resolutions is crucial to meet the new guidelines. By referencing the official guidance provided by the UK government, businesses can ensure compliance and maximize their chances of successfully claiming R&D tax relief.

The team at FD are experts in assessing and compiling R&D tax relief claims, particularly within the life science, biotech and technology sectors and seek to actively support SME claimants in undertaking this work.

Contact us today to organise a no obligation conversation about the R&D tax relief system and how these changes may impact your business.

Contributors

Thomas Wells, Director of Commercial Growth

Explore related insights

-

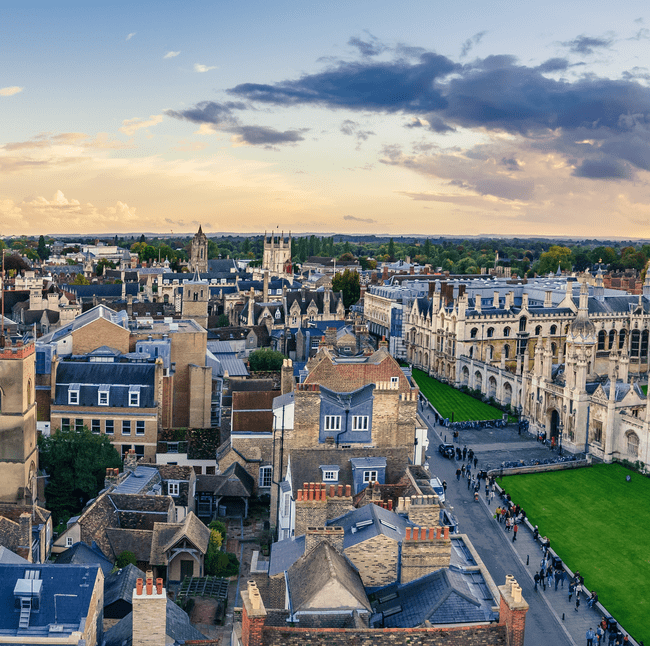

Does the UK Tech and Life Sciences Sector Need the US?

Read more: Does the UK Tech and Life Sciences Sector Need the US?

-

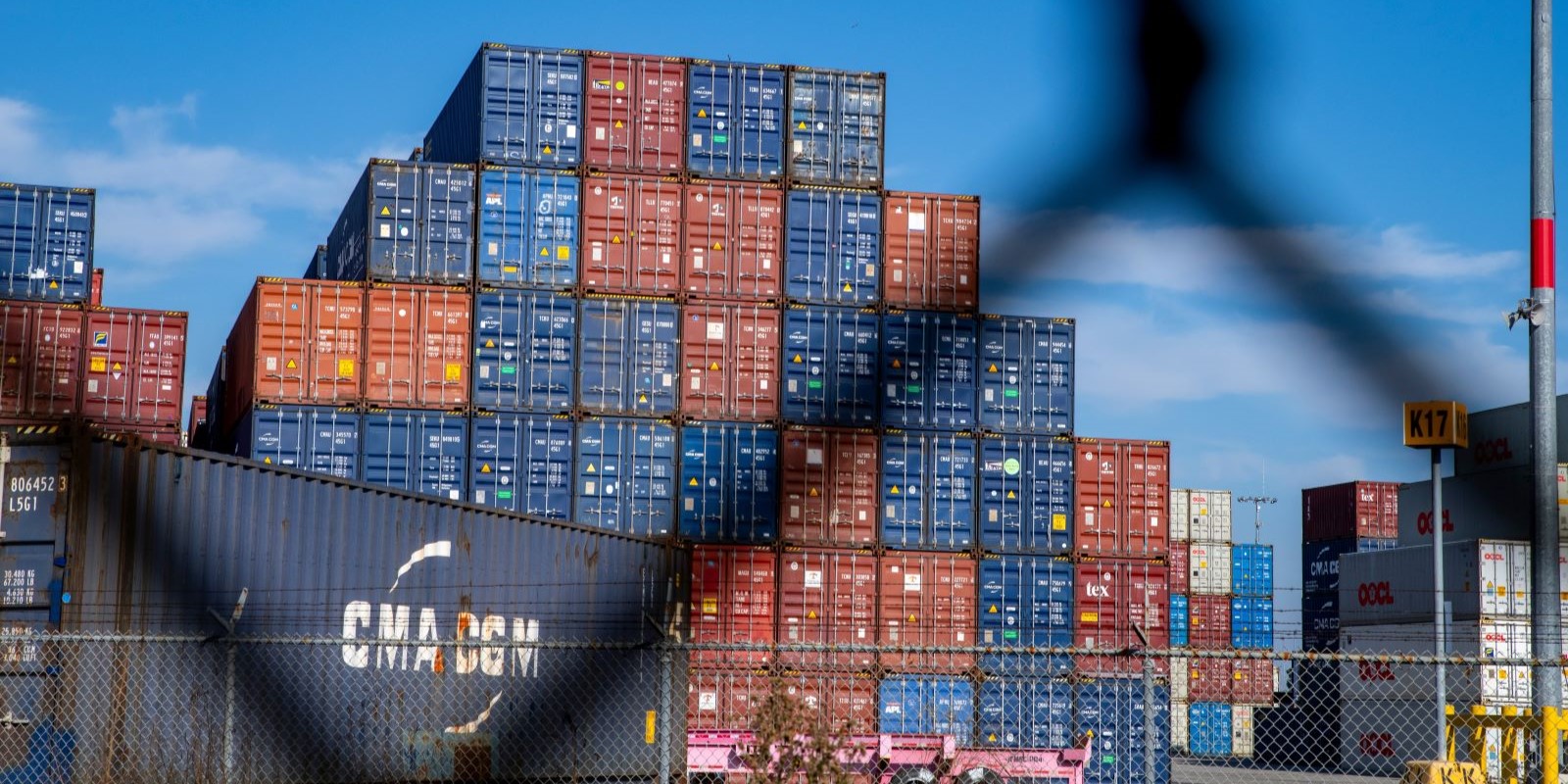

Mitigating US Tariffs Through Effective International Structuring, Supply Chain Planning and Transfer Pricing

Read more: Mitigating US Tariffs Through Effective International Structuring, Supply Chain Planning and Transfer Pricing