Life Sciences

Business challenges posed by tech, biotech and life sciences companies are complex and require specialised knowledge to resolve. FD’s extensive experience supporting these industries while they innovate and bring products and services to market makes us a trusted resource as companies transform and grow.

Featured Insight

Impact of Autumn Budget on Technology & Life Science Startups

With the new government now in office and the 2024 Autumn Budget announcement on 30 October, significant changes are anticipated, especially as the government has emphasized the need to make “difficult decisions”.

In this video, learn how these latest policy changes may affect growth-stage companies in the technology and life sciences sectors across the UK.

Recent Insights & Resources

More on Healthcare & Life Sciences

-

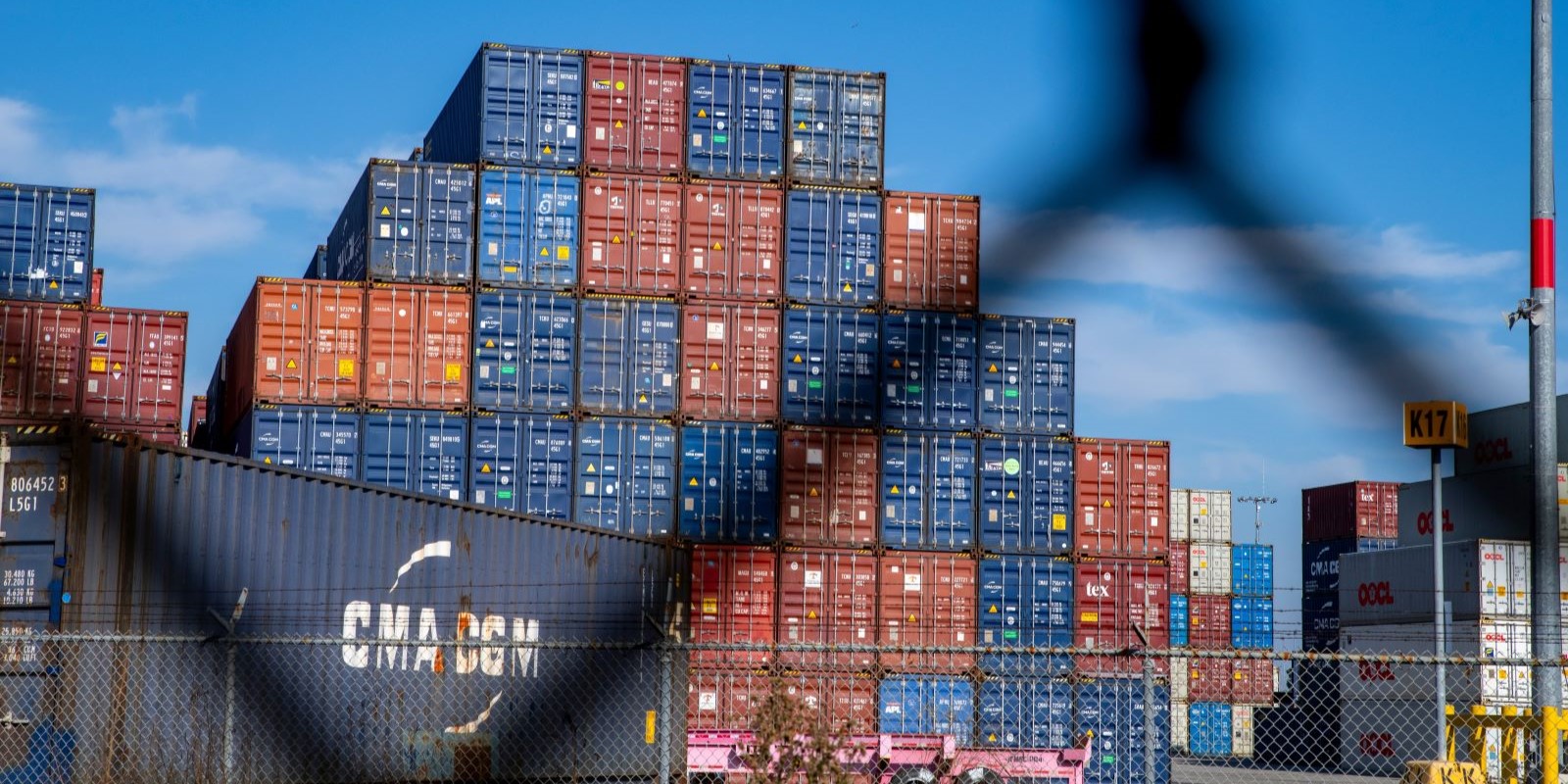

Mitigating US Tariffs Through Effective International Structuring, Supply Chain Planning and Transfer Pricing

Read more: Mitigating US Tariffs Through Effective International Structuring, Supply Chain Planning and Transfer Pricing

-

Optimising R&D Tax Position and CFC/PFIC Analysis for Successful Fundraising: A Case Study

Read more: Optimising R&D Tax Position and CFC/PFIC Analysis for Successful Fundraising: A Case Study