R&D Tax Relief: A Step Change in Compliance Requirements

The UK’s Research & Development (R&D) regime has been in the news since the start of 2022. The Government has been concerned about both the quantum and quality of claims and has been at pains to reduce the perceived levels of abuse. The March 2023 Budget cast...

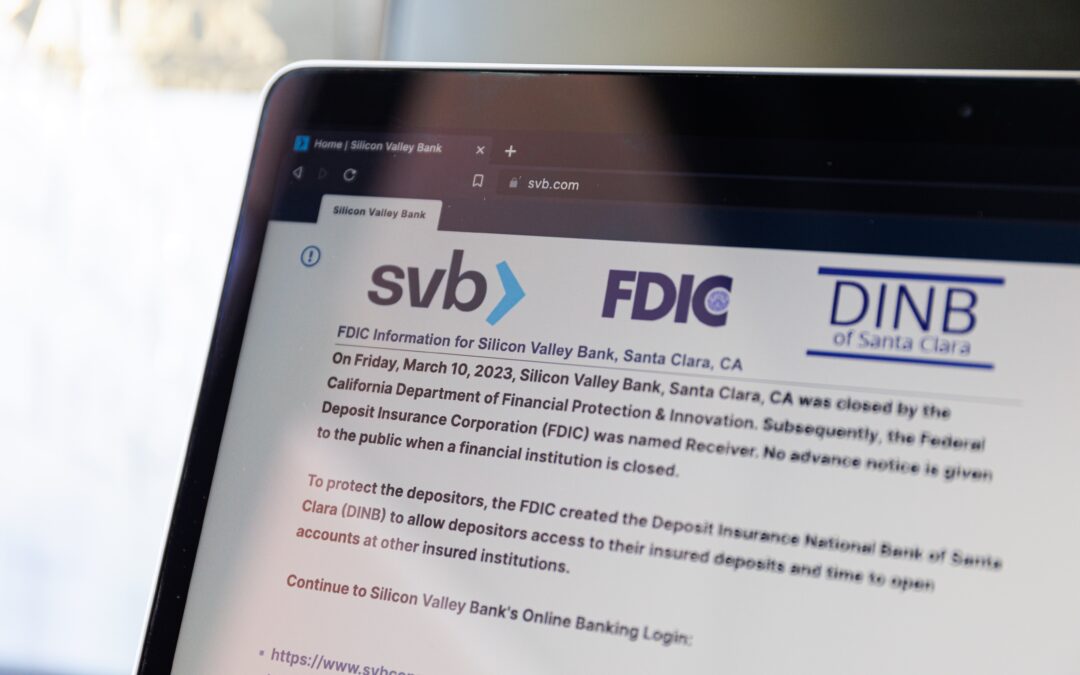

The SVB Impact on FD Clients

At Frazier & Deeter, we understand that the recent banking crisis sparked by the Federal Deposit Insurance Corporation’s (FDIC) shutdown of Silicon Valley Bank (SVB) in the US has created uncertainty amongst our clients and the technology community at large. Our...

New Rate of R&D Tax Credit Introduced for SMEs

We at Frazier & Deeter and Confluence Tax welcome the recent announcement by the Chancellor of the Exchequer that a new rate of Research & Development (R&D) Tax Credit will be introduced for R&D intensive SMEs (small and medium-sized enterprises) with...